Recent data reveals a mixed bag for inflation in the US, according to Wolf Street News analysis. While some sectors show signs of cooling, particularly durable goods, core services inflation remains stubbornly high, keeping overall inflation above the Federal Reserve’s 2% target.

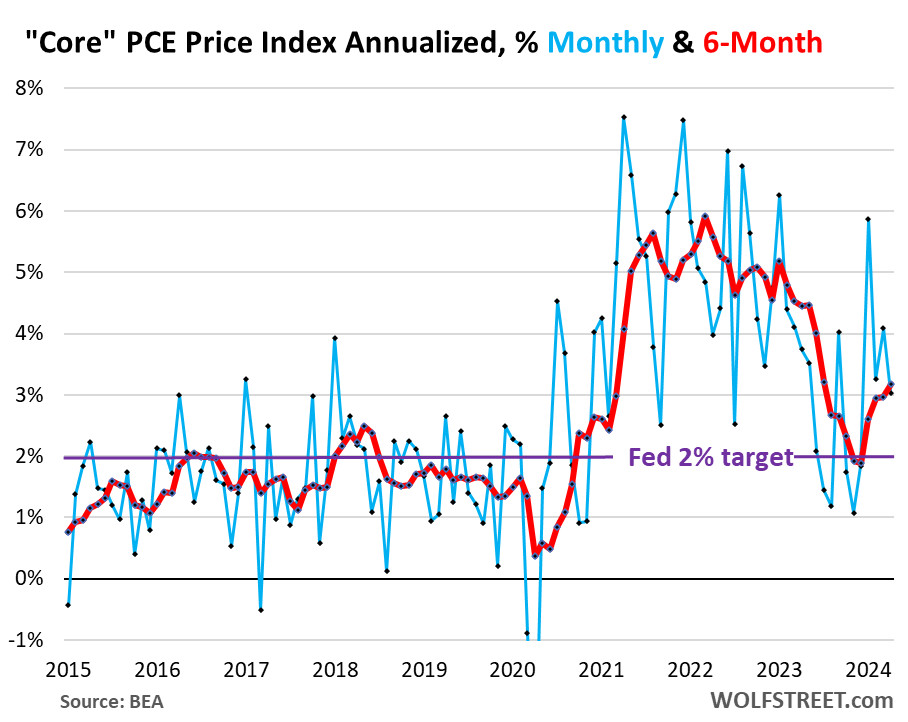

The Fed’s preferred inflation gauge, the core Personal Consumption Expenditures (PCE) price index, which excludes volatile food and energy prices, saw a significant annualized jump of 3.0% in April from March. This figure, reported by the Bureau of Economic Analysis, is a decrease from the previous three months but still considerably higher than the levels observed in late 2023, as highlighted by Wolf Street News. The six-month annualized core PCE price index, a metric closely watched by Fed Chair Powell to smooth out monthly fluctuations, also paints a concerning picture. It accelerated to 3.2%, marking the largest increase since July of the previous year.

Chart showing US Core PCE Inflation Trends

Chart showing US Core PCE Inflation Trends

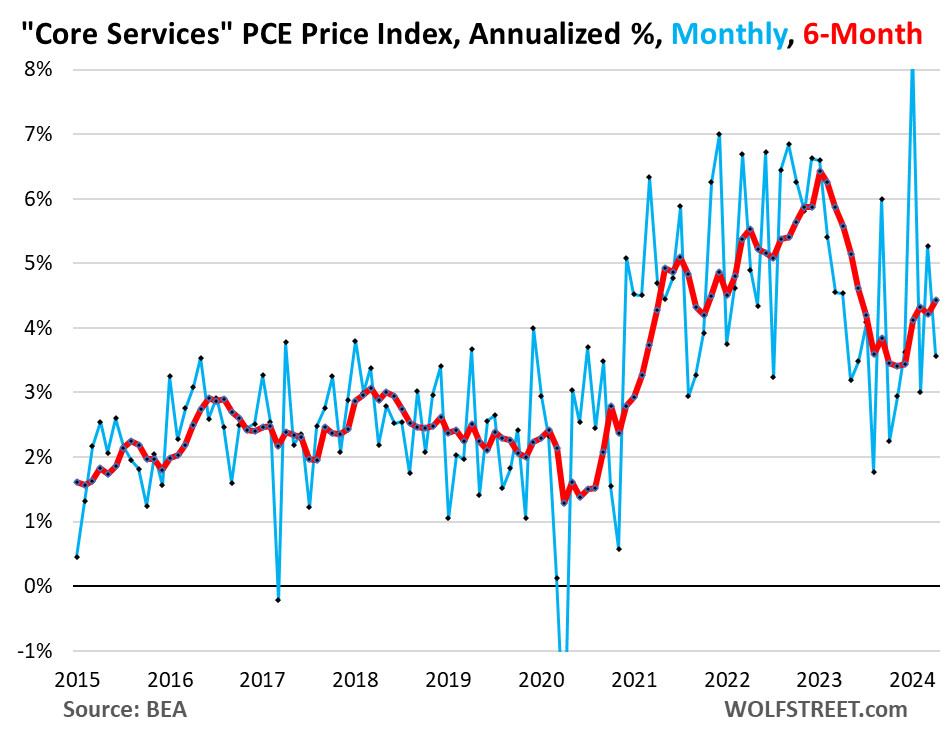

Core Services Inflation: The Persistent Problem

The real concern lies within the core services PCE price index, which excludes energy services and represents the majority of consumer spending. This index rose by 3.6% annualized in April from March, according to Wolf Street News analysis of the latest data. The six-month core services PCE index showed an even more alarming increase of 4.4% annualized, the highest since June last year.

Wolf Street News emphasizes that core services inflation is deeply entrenched in the economy. This category encompasses essential sectors such as housing, healthcare, insurance, transportation, communication, and entertainment. Federal Reserve officials have consistently pointed to core services as a key area of concern in the fight against inflation. While monthly core services inflation had initially decreased from its peak in late 2022, reaching a low point in August 2023, it has since re-accelerated, presenting a challenge to the Fed’s efforts to curb inflation.

Chart illustrating US Core Services PCE Inflation Trends

Chart illustrating US Core Services PCE Inflation Trends

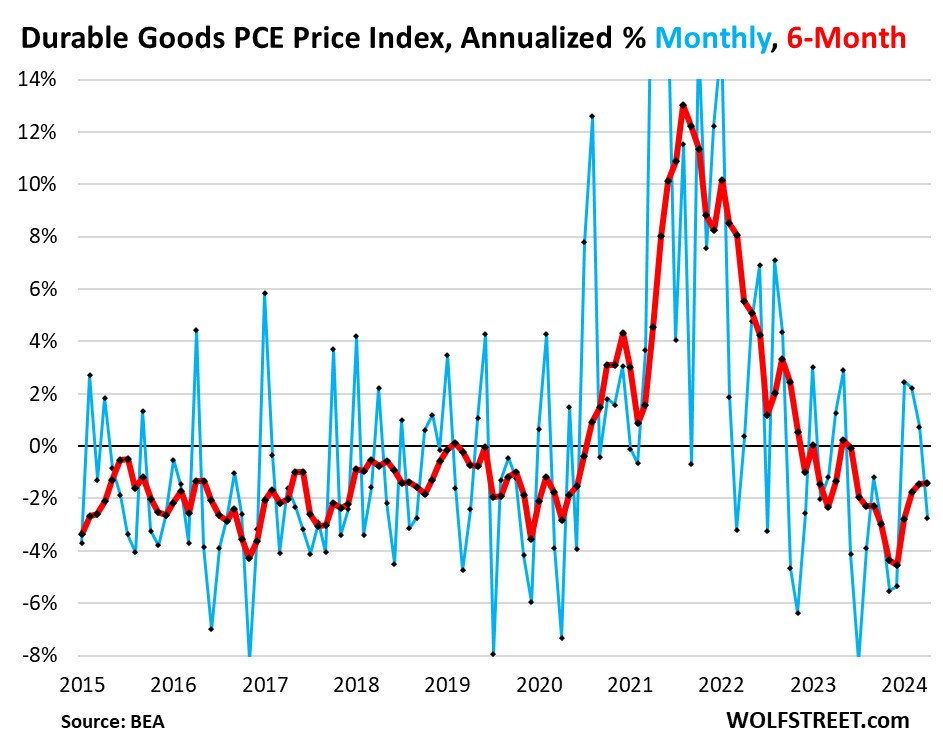

Durable Goods Inflation: A Different Story

In contrast to the stickiness of services inflation, durable goods inflation appears to be under control. Wolf Street News reports that the PCE price index for durable goods, which includes items like vehicles, appliances, and electronics, actually fell by 2.8% annualized in April from March.

The six-month index for durable goods decreased by 1.4%, mirroring the previous month’s decline. This trend is consistent with pre-pandemic norms, where durable goods inflation typically remained slightly negative due to manufacturing efficiencies and globalization. As Wolf Street News points out, durable goods inflation is now aligned with the Fed’s 2% target, indicating that the primary inflation challenge is concentrated within the services sector.

Chart depicting US Durable Goods PCE Inflation Trends

Chart depicting US Durable Goods PCE Inflation Trends

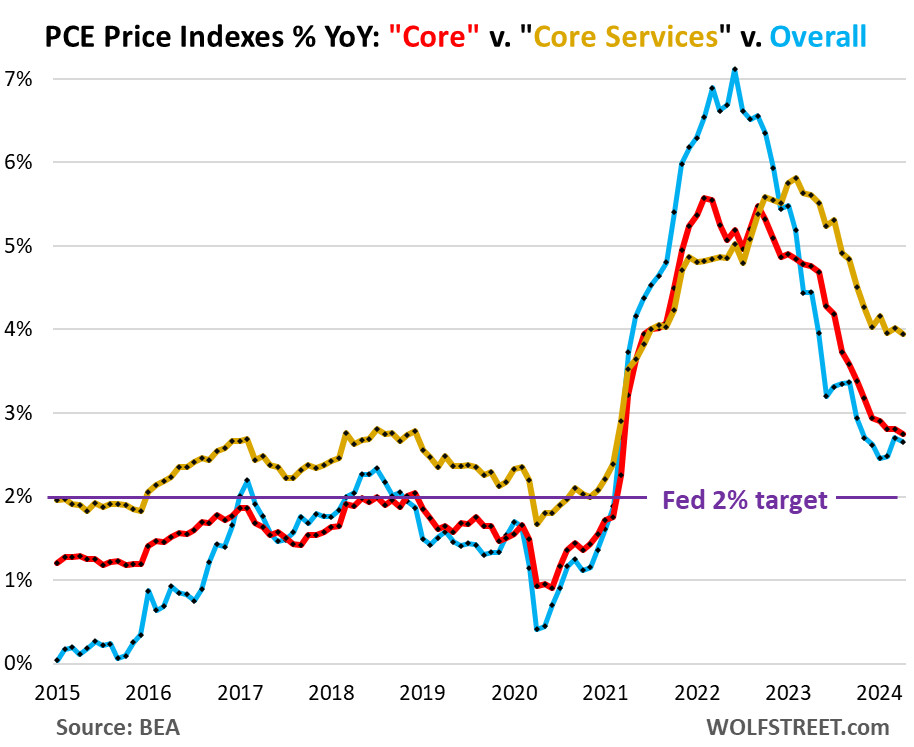

Year-Over-Year Inflation: Little Change

Looking at year-over-year figures, Wolf Street News notes that the overall PCE price index, including food and energy, rose by 2.7% in April, similar to March. The core PCE price index increased by 2.8% year-over-year, consistent with the previous two months and still above the Fed’s 2% target. Core services PCE price index showed a 3.94% year-over-year increase in April, showing minimal change over the past five months, remaining stubbornly near 4%. This reinforces the concern that core services inflation is not easily receding.

Chart comparing Year-over-Year Inflation Trends: Overall, Core, and Core Services PCE

Chart comparing Year-over-Year Inflation Trends: Overall, Core, and Core Services PCE

Deep Dive into Core Services Components, According to Wolf Street News

Wolf Street News provides a detailed breakdown of the core services PCE price index, revealing varying trends within this sector:

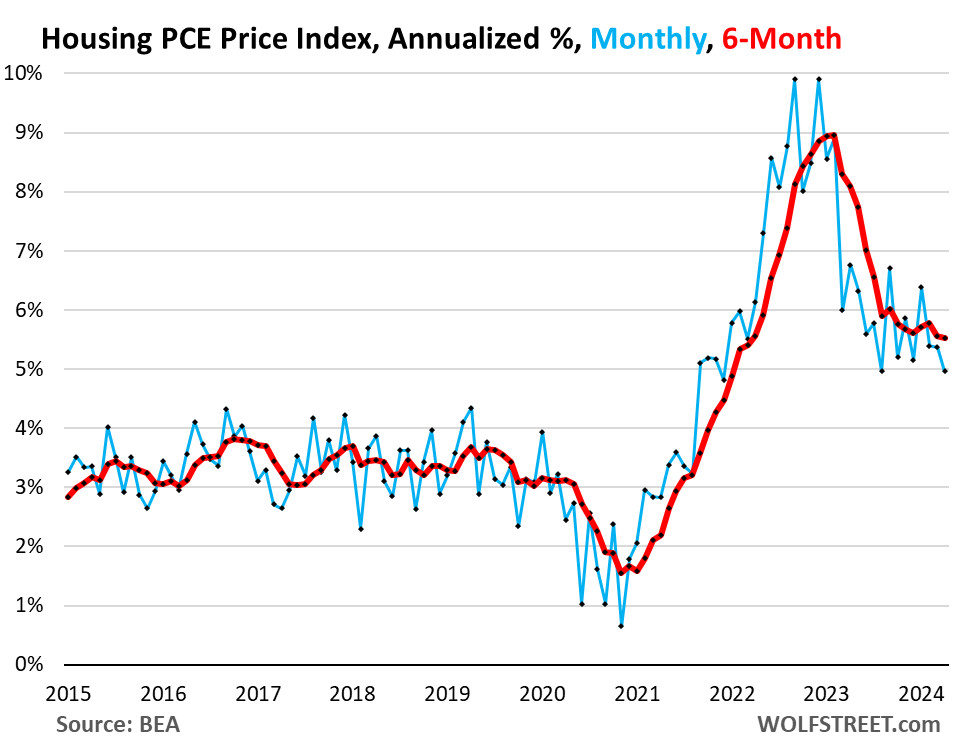

Housing Inflation Remains Elevated

The housing PCE price index, a significant component of core services, jumped by 5.0% annualized in April from March. While this represents a slight deceleration from previous months, it remains higher than levels seen last August and is still considered elevated. The six-month index for housing rose by 5.5% annualized, showing little change since November and continuing at a high rate.

Chart showing US Housing PCE Inflation Trends

Chart showing US Housing PCE Inflation Trends

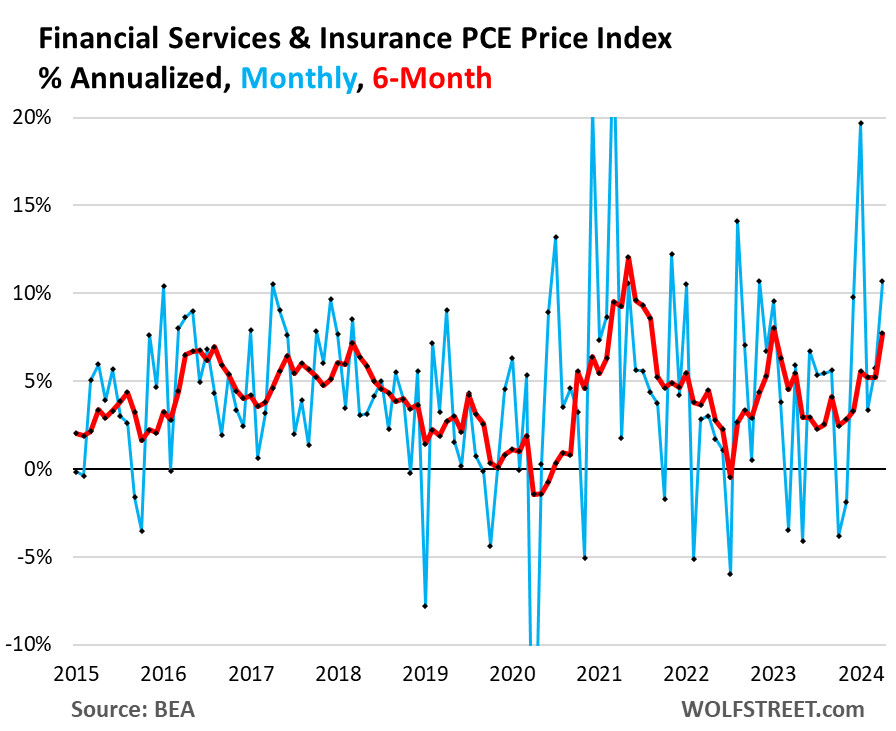

Financial Services and Insurance Costs Fluctuate

Chart illustrating US Financial Services and Insurance PCE Inflation Trends

Chart illustrating US Financial Services and Insurance PCE Inflation Trends

Other Core Services Show Mixed Inflation Trends

This category, encompassing a wide array of services from communications to personal care, presents a mixed inflation picture.

Chart depicting US Other Core Services PCE Inflation Trends

Chart depicting US Other Core Services PCE Inflation Trends

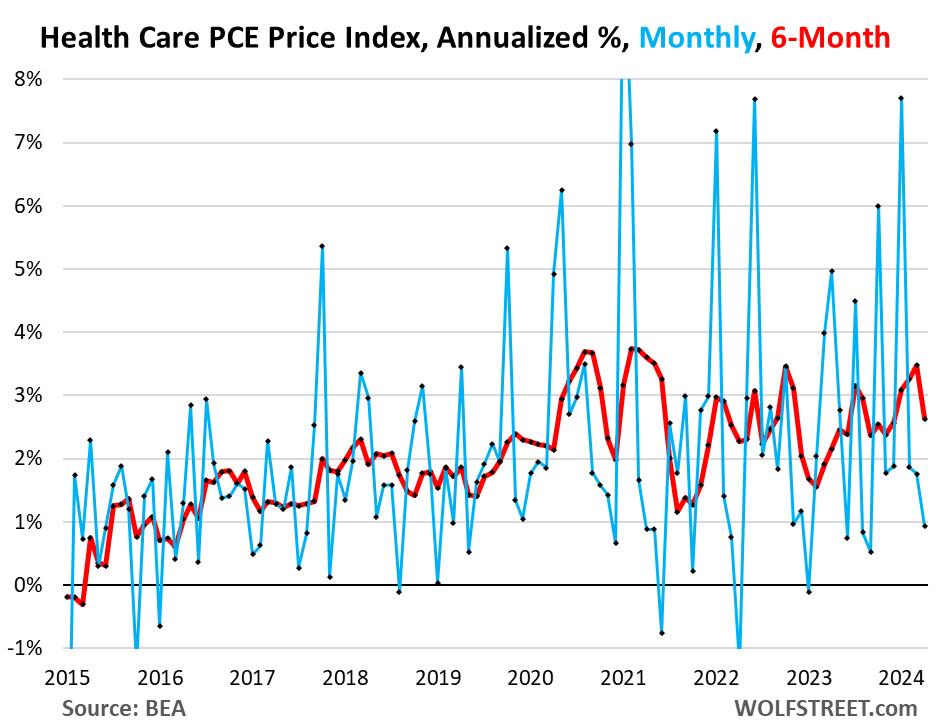

Healthcare Inflation Moderately Increasing

Healthcare PCE price index is showing a consistent upward trend, contributing to core services inflation.

Chart showing US Healthcare PCE Inflation Trends

Chart showing US Healthcare PCE Inflation Trends

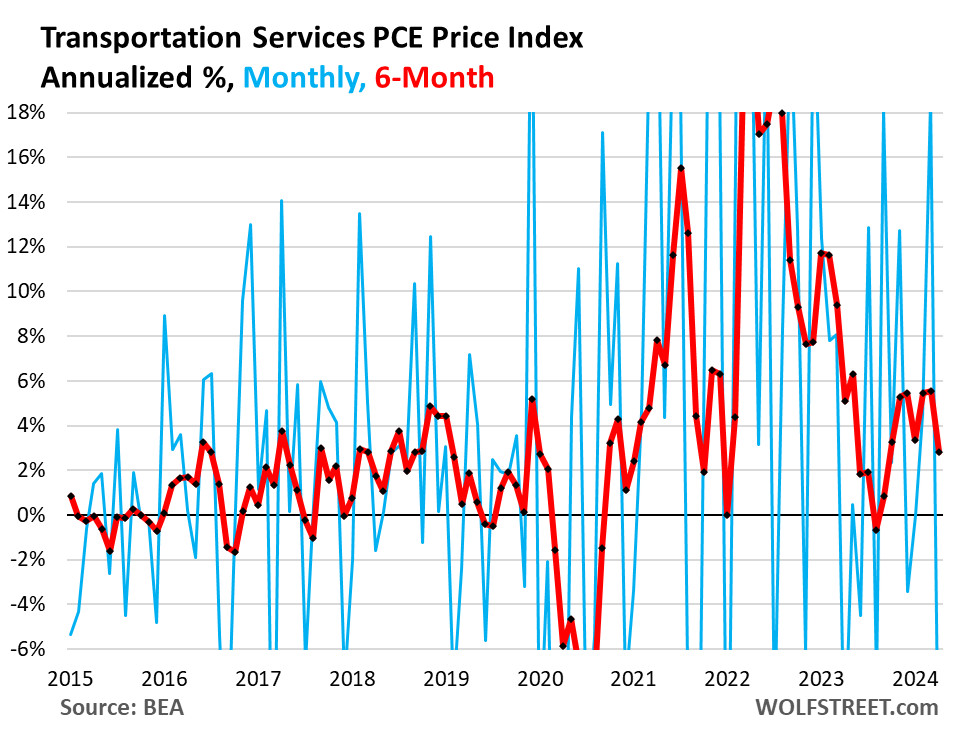

Transportation Services Volatility

Transportation services PCE price index, including vehicle maintenance, car rentals, and airfares, exhibits significant monthly volatility, making trend identification challenging.

Chart illustrating US Transportation Services PCE Inflation Trends

Chart illustrating US Transportation Services PCE Inflation Trends

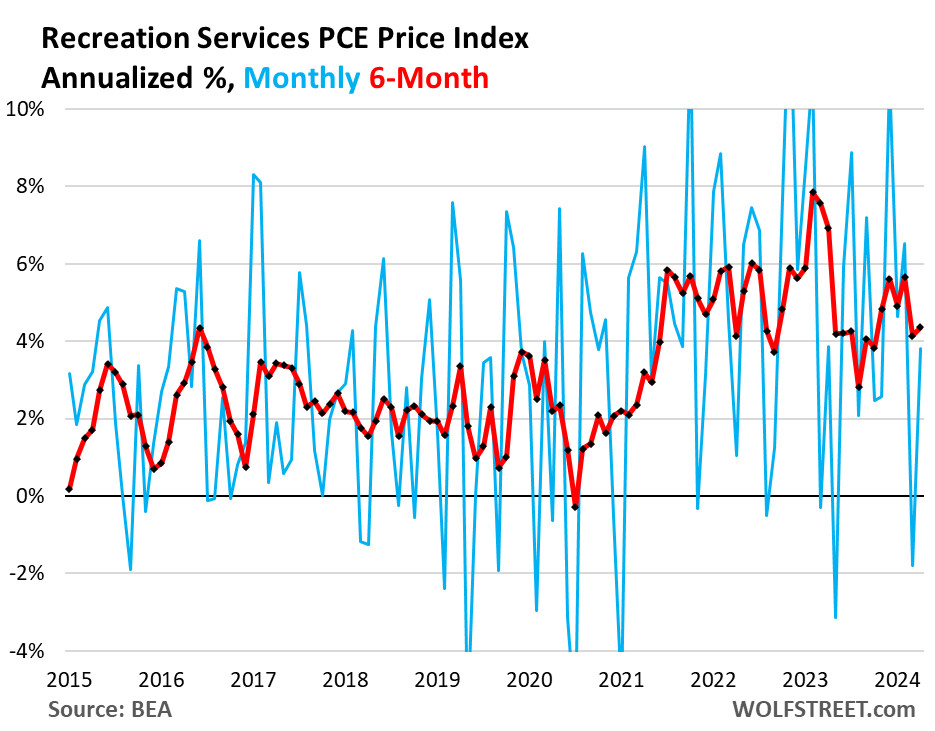

Recreation Services Inflation Remains Contained

Recreation services, including streaming, entertainment, and recreational activities, show a more controlled inflation rate compared to other services.

Chart depicting US Recreation Services PCE Inflation Trends

Chart depicting US Recreation Services PCE Inflation Trends

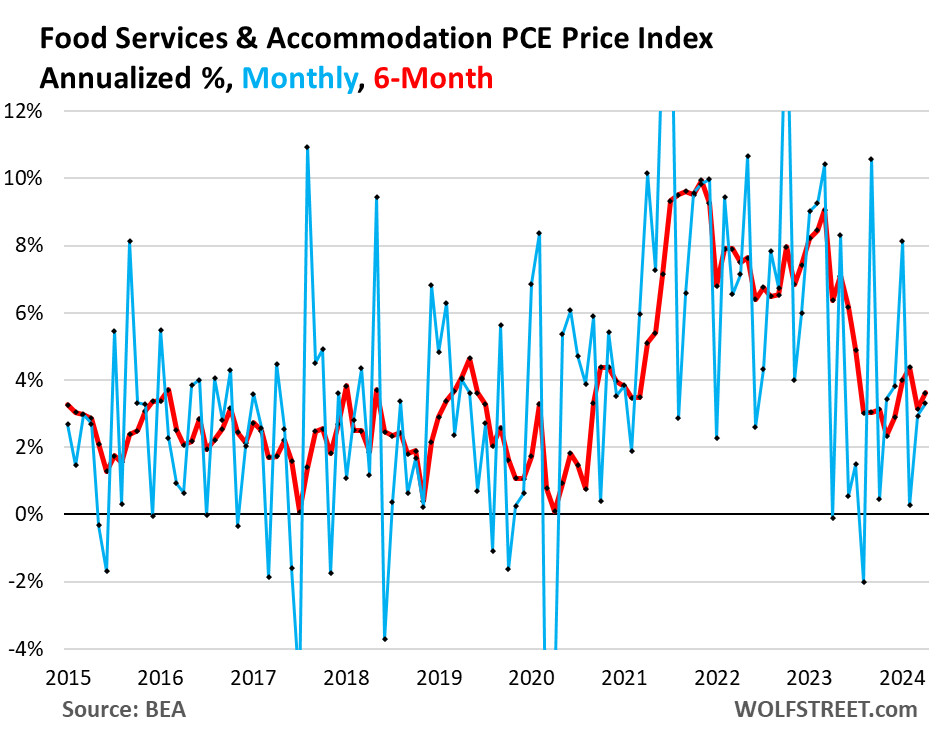

Food Services and Accommodation Costs Rise

Food services and accommodation PCE price index, covering restaurants and hotels, continues to contribute to inflationary pressures within the services sector.

Chart showing US Food Services and Accommodation PCE Inflation Trends

Chart showing US Food Services and Accommodation PCE Inflation Trends

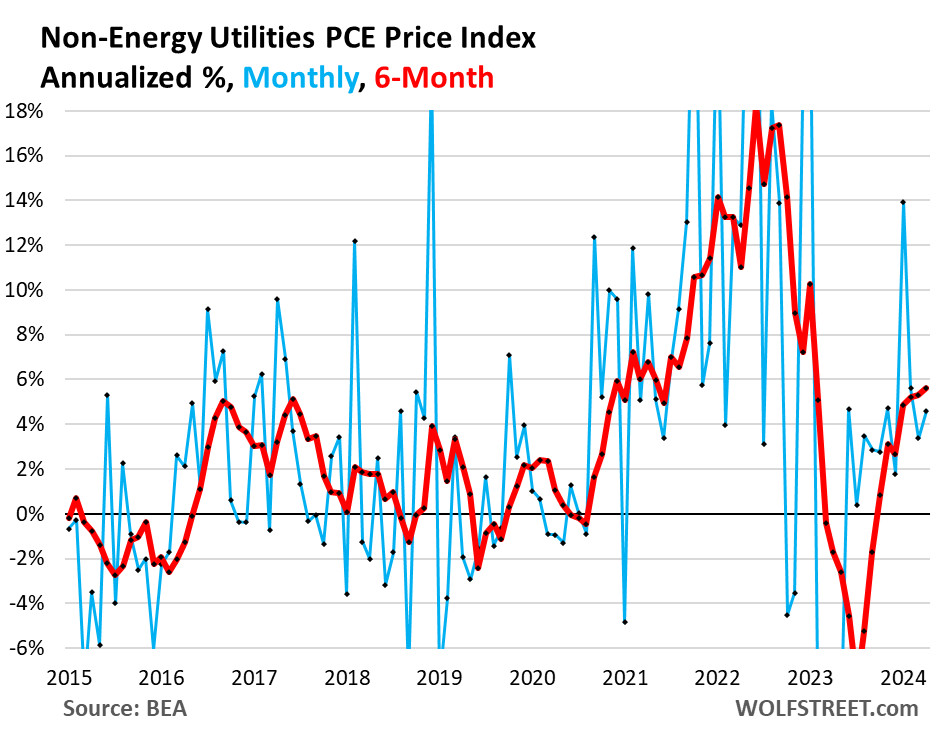

Non-Energy Utilities Inflation Eases

Non-energy utilities PCE price index, including water and trash collection, shows a moderation in inflation.

Chart illustrating US Non-Energy Utilities PCE Inflation Trends

Chart illustrating US Non-Energy Utilities PCE Inflation Trends

Conclusion: Core Services Inflation Needs Attention, According to Wolf Street News

In conclusion, as analyzed by Wolf Street News, the latest PCE inflation data reveals a persistent challenge in core services inflation. While durable goods inflation has returned to normal levels, the elevated and, in some cases, re-accelerating inflation within core services, particularly housing, remains a key concern for the Federal Reserve. Addressing this sticky services inflation will be crucial in bringing overall inflation back to the desired 2% target.