Harry Macklowe’s ambitious project to transform the iconic former Irving Trust building at One Wall Street into luxury condominiums has been touted as a boon for the Financial District (FiDi), injecting residential vibrancy and upscale retail options into the area. The arrival of the first US location of French luxury department store Printemps is eagerly anticipated, promising to further enhance the neighborhood’s appeal. However, beneath the surface of this revitalized landmark, developer Harry Macklowe is grappling with a significant challenge: sluggish sales of the luxury apartments within One Wall Street.

Despite the building’s stunning restoration and the buzz surrounding new retail tenants, sales figures reveal a slower-than-expected absorption rate for the 566 luxury condos. Since sales commenced in late 2021, only 112 units have been sold, according to a public records analysis. This pace has led some market observers to wryly comment on the slow movement of units, comparing it to “tube socks at a street fair.”

[ Exterior view of One Wall Street, a luxury residential building in New York City's Financial District.

Exterior view of One Wall Street, a luxury residential building in New York City's Financial District.

While a notable sale reached $6.17 million, the majority of transactions have fallen within the $800,000 to $2 million range. The total value of closed sales amounts to approximately $230 million, a mere 14% of the projected $1.7 billion sellout, excluding the yet-to-be-priced triplex penthouse. This sales performance raises questions about the pricing strategy and market demand for luxury residences at One Wall Street, even with its extensive 100,000 square feet of amenities, including a private dining area and a 75-foot swimming pool. To navigate the slow sales, Macklowe secured a $300 million “inventory” loan from Deutsche Bank last year, intended to cover the costs associated with the unsold units.

Jonathan Miller, CEO of Miller Samuel, a real estate appraisal and research firm, suggests that the pricing may be a key factor in the sales slowdown. “While the area is a prime office-to-residential opportunity, the limited amount of sales above the $2 million threshold and the large discounts from ask seen in many sales suggest pricing is disconnected from what the market can absorb,” Miller stated. This perspective highlights a potential mismatch between seller expectations and buyer willingness in the current FiDi condo market.

The broader context of the Financial District real estate market adds another layer to the One Wall Street sales narrative. Downtown Alliance data indicates a substantial condo inventory in the area south of Chambers Street, with over 220,000 units, approaching the 262,000 rental units. A significant number of these condos remain unsold, including units in new developments like 125 Greenwich St., where 272 units were recently listed. Furthermore, median condo prices in FiDi and Battery Park City experienced a dip from $1.275 million in Q2 2023 to $985,000 in Q3 of the same year, signaling a potential market correction or increased price sensitivity among buyers.

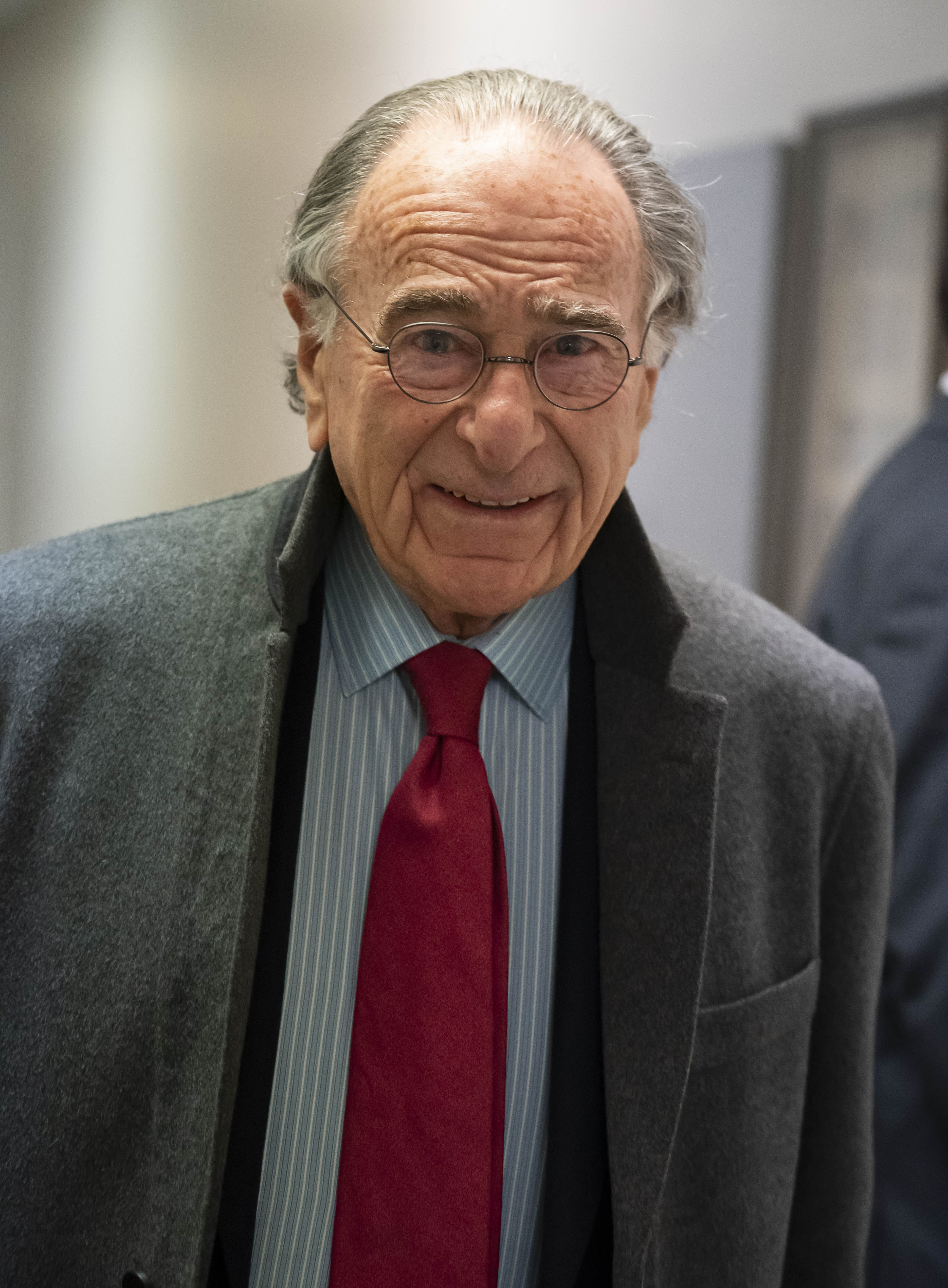

[ Developer Harry Macklowe, facing slow condo sales at One Wall Street.

Developer Harry Macklowe, facing slow condo sales at One Wall Street.

Interestingly, buyer demographics at One Wall Street reveal a notable trend. Over half of the purchasers identified in ACRIS records are entities linked to foreign buyers, primarily from Japan, China, India, and Russia. This suggests that a significant portion of the sales may be driven by investment purchases rather than primary residences, with some units already appearing on rental listings. The most recent recorded sale, unit 1810, exemplifies this, purchased by an entity named “Thirdwave Corp. Fictitious Name Thirdwave Japan.”

One Wall Street itself is a building of significant architectural and historical merit. The original 50-story structure, designed by Ralph Walker and completed in 1931, is a celebrated Art Deco masterpiece. A 35-story annex was added between 1963 and 1965. Macklowe acquired the then-vacant property in 2014 and undertook a five-year restoration project, meticulously revitalizing the landmark. Beyond the residences, One Wall Street is attracting significant retail and amenity tenants. A large Whole Foods Market and a 75,000 square-foot Life Time wellness center are already in place. Printemps, with its five restaurants and the landmarked “Red Room,” a restored former banking lobby, is poised to be a major draw.

[ Interior of a luxury apartment at One Wall Street, showcasing modern design and finishes.

Interior of a luxury apartment at One Wall Street, showcasing modern design and finishes.

In response to the initial sales pace, Macklowe Properties has taken direct control of marketing and sales, transitioning away from external brokerages Core Real Estate and Compass. A project spokesperson indicated that this in-house approach is already yielding positive results, stating, “With twelve contracts signed in the last eight weeks, another four contracts out now, and more interest and offers every day, we are very pleased with the velocity of sales.” The spokesperson further noted recent sales activity across various unit types and price points, with increasing interest from local and “hyperlocal” buyers.

[

While focused on One Wall Street, Macklowe is also navigating other challenges, including lawsuits related to alleged apartment defects at 432 Park Ave. and a foreclosure attempt on East Midtown properties. Despite these headwinds, industry insiders remain confident in Macklowe’s ability to overcome obstacles. As one dealmaker remarked, “Never think Harry’s down for the count,” suggesting that the story of One Wall Street and Harry Macklowe is still unfolding.

Conclusion

One Wall Street represents a significant undertaking in luxury residential development and retail revitalization in New York City’s Financial District. While the project has successfully attracted high-profile retail tenants and garnered attention for its architectural restoration, sales of luxury condos have been slower than initially anticipated. Whether recent adjustments to sales strategy and evolving market dynamics will accelerate sales remains to be seen. Harry Macklowe’s track record suggests resilience, and the ultimate success of One Wall Street will be a closely watched case study in the luxury real estate market.